NEW YORK, New York - Technology stocks fell sharply Wednesday, dragging down the industrial sector in its wake, as Donald Trump's trade war continued to wreak havoc across global financial markets.

U.S. Federal Reserve Jay Jay Powell said the central bank was concerned about the challenges of inflation and growth.

"We may find ourselves in the challenging scenario in which our dual-mandate goals are in tension," he said ahead of an address to the Economic Club of Chicago. "If that were to occur, we would consider how far the economy is from each goal, and the potentially different time horizons over which those respective gaps would be anticipated to close."

Analyst Nathan Sheets projects global growth this year will soften to 2.1 percent.

"U.S. tariff rates have risen to historically high levels, and this is creating challenging headwinds for the global economy," he wrote Wednesday, according to CNBC. "In addition to the direct effects of the tariffs, these headwinds include amplified policy uncertainty, sharply declining sentiment, and adverse wealth effects."

"Given the trajectory of recent developments, the risks to our forecast are strongly skewed to the downside," Sheets said.

Following are Wednesday's closing quotes for the key U.S. stock indices:

-

Standard and Poor'd 500 fell by 120.93 points, or 2.24 percent, to close at 5,275.70.

-

Dow Jones Industrial Average declined by 699.57 points, or 1.73 percent, ending at 39,669.39.

-

NASDAQ Composite dropped by 516.01 points, or 3.07 percent, settling at 16,307.16.

The technology sector was particularly affected, with Nvidia's shares tumbling 6.5 percent following the announcement of anticipated losses due to the export ban

Global Currencies Gain as U.S. Dollar Slips Amid Trade Uncertainty

The U.S. dollar continued its decline on Wednesday, as global currencies strengthened amid investor concerns over escalating trade tensions and anticipation of upcoming economic data. The greenback's weakness was evident across major currency pairs, reflecting shifting market sentiments. The US Dollar Index fell by 0.85 points, or 0.85 percent, to 99.36.

Euro Advances on Dollar Weakness

The euro rose to 1.1389 against the U.S. dollar, marking a gain of 0.98 percent. This uptick is attributed to the dollar's vulnerability stemming from uncertainties surrounding U.S. trade policies. Analysts suggest that the euro could see further gains if the dollar's softness persists .

Yen Strengthens Amid Risk Aversion

The U.S. dollar fell to 142.07 yen, a decrease of 0.81 percent. Investors are gravitating towards the yen, traditionally viewed as a safe-haven currency, amid ongoing trade negotiations and geopolitical uncertainties .

Canadian Dollar Gains Despite Inflation Concerns

The U.S. dollar declined by 0.70 percent against the Canadian dollar, settling at 1.3859. This movement comes despite recent Canadian inflation data falling short of expectations, suggesting that broader market dynamics are influencing the exchange rate

British Pound Edges Higher

The British pound experienced a modest rise of 0.10 percent against the U.S. dollar, reaching 1.3240. This increase occurred despite lower-than-anticipated U.K. inflation figures, indicating resilience in the pound's performance .

Swiss Franc Nears Decade High

The U.S. dollar dropped to 0.8134 against the Swiss franc, a decline of 1.20 percent. The franc's appreciation brings it close to a ten-year high, with market speculation suggesting that the Swiss National Bank may refrain from intervening to curb its strength .

Australian and New Zealand Dollars Strengthen

The Australian dollar rose by 0.42 percent to 0.6370 against the U.S. dollar, while the New Zealand dollar increased by 0.58 percent to 0.5931. Both currencies are benefiting from the dollar's overall weakness and positive regional economic indicators .

Outlook

Market participants are closely monitoring upcoming U.S. retail sales data and a scheduled speech by Federal Reserve Chair Jerome Powell for further insights into the economic trajectory. The dollar's recent performance reflects heightened sensitivity to trade developments and economic indicators, suggesting continued volatility in the foreign exchange markets.

Global Stock Markets React to U.S.-China Trade Tensions

April 16, 2025

Global stock markets experienced mixed performances on Wednesday, influenced by escalating trade tensions between the U.S. and China, as well as varying economic indicators across regions.

United States: Significant Declines Across Major Indices

U.S. markets closed sharply lower amid concerns over new export restrictions on semiconductor sales to China and comments from Federal Reserve Chair Jerome Powell indicating a potential slowdown in economic growth.

-

Standard and Poor's 500 fell by 120.93 points, or 2.24 percent, to close at 5,275.70.

-

Dow Jones Industrial Average declined by 699.57 points, or 1.73 percent, ending at 39,669.39.

-

NASDAQ Composite dropped by 516.01 points, or 3.07 percent, settling at 16,307.16.

The technology sector was particularly affected, with Nvidia's shares tumbling 6.5 percent following the announcement of anticipated losses due to the export ban .

Europe: Mixed Results Amid Economic Indicators

European markets showed varied outcomes as investors weighed regional economic data against global trade concerns.

-

FTSE 100 in London rose by 26.48 points, or 0.32 percent, closing at 8,275.60 .

-

DAX in Germany increased by 57.32 points, or 0.27 percent, to 21,311.02

-

CAC 40 in France slightly decreased by 5.43 points, or 0.07 percent, ending at 7,329.97 .

-

EURO STOXX 50 edged down by 3.93 points, or 0.08 percent, to 4,966.50.

-

Euronext 100 Index fell by 1.78 points, or 0.12 percent, closing at 1,463.83.

-

BEL 20 in Belgium gained 5.68 points, or 0.14 percent, reaching 4,200.98.

Asia-Pacific: Divergent Performances

Asian markets reflected a range of outcomes, influenced by local economic conditions and global trade developments.

-

Hang Seng Index in Hong Kong declined by 409.29 points, or 1.91 percent, to 21,056.98.

-

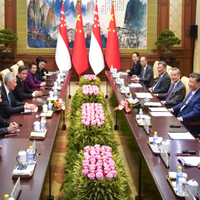

Straits Times Index in Singapore rose by 37.73 points, or 1.04 percent, ending at 3,662.45.

-

S&P/ASX 200 in Australia slightly decreased by 2.80 points, or 0.04 percent, to 7,758.90.

-

All Ordinaries dipped by 8.20 points, or 0.10 percent, closing at 7,961.70.

-

S&P BSE SENSEX in India advanced by 309.40 points, or 0.40 percent, reaching 77,044.29.

-

FTSE Bursa Malaysia KLCI fell by 9.51 points, or 0.64 percent, to 1,476.92.

-

S&P/NZX 50 Index in New Zealand increased by 56.58 points, or 0.47 percent, ending at 12,067.92.

-

KOSPI Composite Index in South Korea dropped by 29.98 points, or 1.21 percent, to 2,447.43.

-

TWSE Capitalization Weighted Stock Index in Taiwan decreased by 389.67 points, or 1.96 percent, closing at 19,468.00.

Other Markets: Varied Movements

-

S&P/TSX Composite Index in Canada rose by 38.89 points, or 0.16 percent, to 24,106.79.

-

TA-125 in Israel gained 9.88 points, or 0.39 percent, ending at 2,535.33.

-

EGX 30 Price Return Index in Egypt declined by 154.30 points, or 0.49 percent, to 31,030.70.

-

Top 40 USD Net TRI Index in South Africa increased by 60.88 points, or 1.31 percent, reaching 4,718.14.

-

SSE Composite Index in China edged up by 8.34 points, or 0.26 percent, closing at 3,276.00.

-

Nikkei 225 in Japan decreased by 347.14 points, or 1.01 percent, to 33,920.40.

Related stories:

Tuesday 15 April 2025 | U.S. stocks slide, Dow Jones drops 156 points | Big News Network

Monday 14 April 2025 | Dow Jones closes 312 points higher as stocks recover | Big News Network